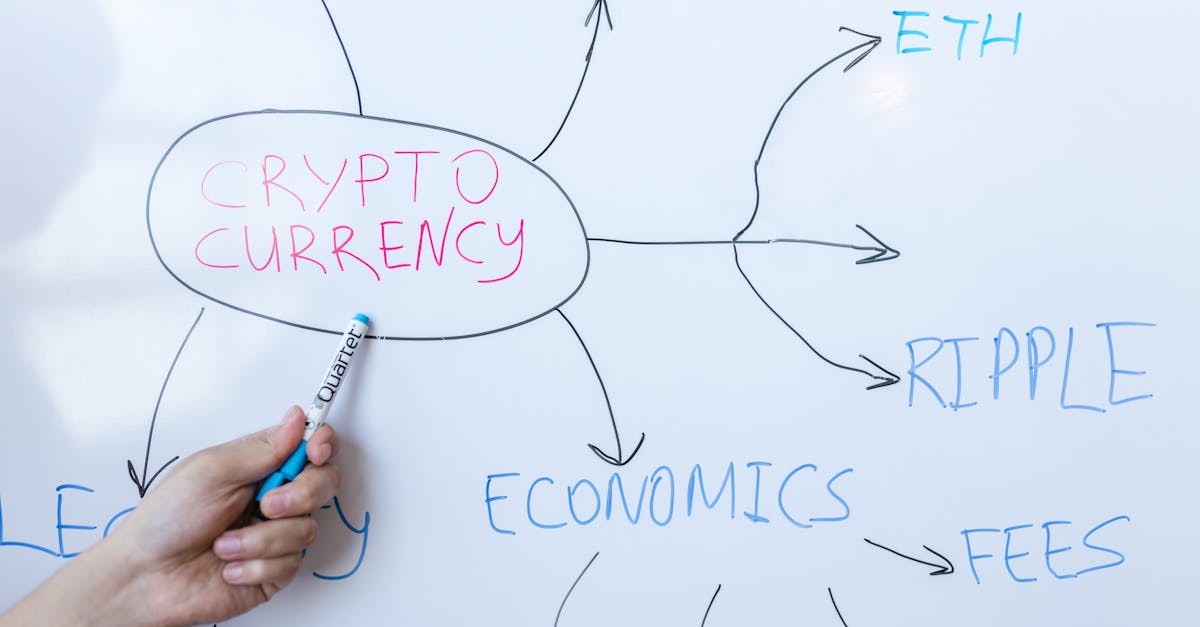

Introduction

Cryptocurrency has come a long way since Bitcoin’s humble beginnings in 2009. What was once a niche interest for tech enthusiasts and libertarians has evolved into a multi-trillion-dollar market that includes everything from decentralized finance (DeFi) platforms to NFTs. And with this rapid growth, regulation has become an increasingly pressing issue. So, what does the future hold for cryptocurrency regulation? Will governments step in to impose strict rules, or will they adopt a more hands-off approach?

The Current State of Cryptocurrency Regulation

Before we look ahead, let’s quickly check out where we stand today. Cryptocurrency regulation is a patchwork of laws, rules, and guidelines, often inconsistent and, at times, contradictory. In the U.S., for example, the Securities and Exchange Commission (SEC) has been grappling with the question of whether cryptocurrencies are securities or commodities. Other countries, like China, have outright banned crypto trading, while places like El Salvador have fully embraced it by making Bitcoin legal tender.

Despite the lack of uniformity, there’s one thing that’s clear: cryptocurrency regulation is coming, whether the industry is ready for it or not. The question is: How will this all unfold?

The Role of Governments and International Cooperation

Governments around the world are starting to recognize the growing influence of cryptocurrency and are beginning to implement more formal regulations. In the European Union, the Markets in Crypto-Assets (MiCA) regulation is set to create a standardized framework for digital asset businesses. Meanwhile, the U.S. is slowly moving toward clearer guidelines, with the Biden administration calling for greater crypto regulation in 2021 and beyond. This signals that some form of oversight is likely on the horizon.

However, the real challenge is creating international consensus. Cryptocurrency is inherently global, and it doesn’t follow national borders. If countries regulate digital assets differently, it could create a situation where businesses and investors play one country against another, or worse, crypto could become an unregulated free-for-all in certain jurisdictions. That’s why international cooperation will be key. A globally agreed-upon set of standards could help foster greater transparency, reduce risks, and protect investors without stifling innovation.

Example: The EU’s MiCA Framework

One of the most ambitious attempts at international regulation is the EU’s MiCA framework. MiCA aims to create a unified set of rules for the entire European Union, providing much-needed clarity to businesses and consumers. The goal is not to crush innovation but to offer a balanced approach that ensures the safety and security of digital assets. As the EU’s framework develops, it could serve as a model for other countries looking to regulate cryptocurrency.

The Rise of Central Bank Digital Currencies (CBDCs)

As governments grapple with how to regulate decentralized cryptocurrencies, many are exploring the possibility of creating their own digital currencies. These are called Central Bank Digital Currencies (CBDCs), and they’re a way for governments to take control of the digital money supply while still providing the benefits of crypto, like faster payments and greater efficiency.

Countries like China are already in the testing phase of their digital yuan, while the U.S. Federal Reserve is exploring a digital dollar. These CBDCs would be centrally controlled by the respective government, making them vastly different from decentralized cryptocurrencies like Bitcoin or Ethereum.

So why does this matter for cryptocurrency regulation? Well, CBDCs could reshape the entire financial landscape. They would offer a regulated alternative to decentralized cryptocurrencies, and potentially change how people perceive and use digital assets. This could lead to stricter regulations on non-government-issued cryptos, as authorities may be less inclined to allow free-market crypto to thrive alongside state-controlled currencies.

Example: China’s Digital Yuan

China’s Digital Yuan, or e-CNY, is one of the most talked-about examples of a CBDC. It’s already being tested in several major cities, and the Chinese government plans to roll it out nationwide in the coming years. Unlike decentralized cryptocurrencies, which allow for privacy and autonomy, the digital yuan gives the Chinese government full visibility into transactions, which could raise concerns about surveillance and privacy. But from a regulatory standpoint, it’s an example of how governments are stepping up their game in the digital asset space.

Consumer Protection and Financial Stability

Another key consideration for cryptocurrency regulation is consumer protection. As the value of crypto assets fluctuates wildly, investors are at risk of losing substantial amounts of money. Additionally, hacks, scams, and rug pulls have become more common, leaving people with little recourse when things go wrong. Governments have a responsibility to create regulations that protect consumers from these risks while also promoting healthy market behavior.

One possible way to achieve this is by requiring greater transparency from cryptocurrency exchanges, wallet providers, and other market participants. For example, businesses could be required to disclose their financial holdings, show how they handle client funds, and adhere to anti-money laundering (AML) and know-your-customer (KYC) regulations.

Example: The Case of Mt. Gox

One of the most infamous examples of a lack of consumer protection is the Mt. Gox exchange hack in 2014. At the time, Mt. Gox was handling 70% of all Bitcoin transactions worldwide. The exchange was hacked, and 850,000 Bitcoins, worth hundreds of millions of dollars at the time, disappeared. Thousands of investors lost their funds, and it took years for the situation to be resolved. If better regulations had been in place, this disaster might have been prevented, or at least mitigated.

Balancing Innovation with Regulation

The future of cryptocurrency regulation will have to strike a delicate balance. Too much regulation could stifle innovation and drive crypto businesses offshore, while too little could expose consumers to more risks and make it easier for bad actors to take advantage of the system.

Some argue that regulations should focus on creating a level playing field, ensuring that all participants follow the same rules. Others believe that crypto’s decentralized nature means it should largely be left alone, allowing the market to self-regulate. Either way, what’s clear is that cryptocurrency isn’t going anywhere, and regulation will likely play a key role in its future.

Conclusion: What’s Next?

As cryptocurrency continues to mature, regulation is inevitable. The question is: What kind of regulation will emerge? Will governments find a way to support innovation while providing the safeguards needed to protect consumers? Will international cooperation create a unified approach to digital assets? Or will individual countries go their own way, resulting in a fragmented global market?

Whatever happens, one thing is certain: the future of cryptocurrency regulation will be critical in shaping the next chapter of digital finance. Investors, businesses, and governments alike will need to stay informed and adaptable as the rules continue to evolve. As we’ve seen in the past, regulation can either foster growth or stifle it, let’s hope we get it right this time.